time to get your calculator out

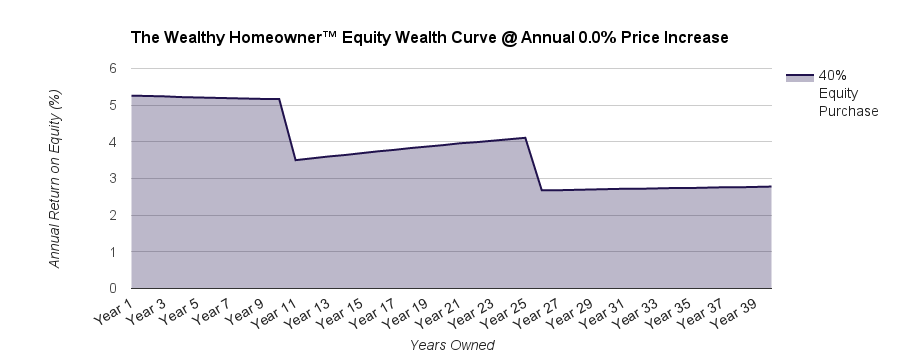

The Wealthy Homeowner™$160,000 down

$1.135.79 per month 25 year amortization Program: Most Conservative 40 Year Tax-FREE Gain $538,940 Origination Equity $160,000

Year 1 @ 5.26 = $168,418 Year 2 @ 5.25 = $177,257 Year 3 @ 5.24 = $186,539 Year 4 @ 5.22 = $196,284 Year 5 @ 5.21 = $206,516 Year 6 @ 5.20 = $217,260 Year 7 @ 5.19 = $228,542 Year 8 @ 5.18 = $240,387 Year 9 @ 5.17 = $252,825 Year 10 @ 5.17 = $265,884 Year 11 @ 3.50 = $275,178 Year 12 @ 3.55 = $284,937 Year 13 @ 3.60 = $295,184 Year 14 @ 3.64 = $305,943 Year 15 @ 3.69 = $317,240 Year 16 @ 3.74 = $329,102 Year 17 @ 3.78 = $341,557 Year 18 @ 3.83 = $354,635 Year 19 @ 3.87 = $368,367 Year 20 @ 3.91 = $382,785 Year 21 @ 3.96 = $397,925 Year 22 @ 3.99 = $413,821 Year 23 @ 4.03 = $430,512 Year 24 @ 4.07 = $448,038 Year 25 @ 4.11 = $466,440 Year 26 @ 2.68 = $478,919 Year 27 @ 2.68 = $491,773 Year 28 @ 2.69 = $505,012 Year 29 @ 2.70 = $518,648 Year 30 @ 2.71 = $532,693 Year 31 @ 2.72 = $547,159 Year 32 @ 2.72 = $562,058 Year 33 @ 2.73 = $577,404 Year 34 @ 2.74 = $593,209 Year 35 @ 2.74 = $609,488 Year 36 @ 2.75 = $626,254 Year 37 @ 2.76 = $643,522 Year 38 @ 2.76 = $661,308 Year 39 @ 2.77 = $679,625 Year 40 @ 2.78 = $698,490 The Wealthy Homeowner™

|

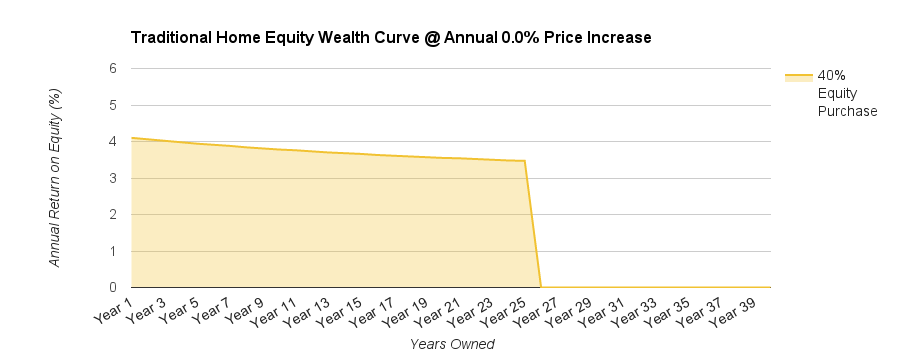

traditional homeowner$160,000 down

$1.135.79 per month 25 year amortization Program: None 40 Year Tax-FREE Gain $240,000 Origination Equity $160,000

Year 1 @ 4.10 = $166,563 Year 2 @ 4.06 = $173,325 Year 3 @ 4.02 = $180,291 Year 4 @ 3.98 = $187,468 Year 5 @ 3.94 = $194,861 Year 6 @ 3.91 = $202,478 Year 7 @ 3.88 = $210,325 Year 8 @ 3.84 = $218,409 Year 9 @ 3.81 = $226,738 Year 10 @ 3.78 = $235,319 Year 11 @ 3.76 = $244,158 Year 12 @ 3.73 = $253,265 Year 13 @ 3.70 = $262,648 Year 14 @ 3.68 = $272,313 Year 15 @ 3.66 = $282,271 Year 16 @ 3.63 = $292,530 Year 17 @ 3.61 = $303,099 Year 18 @ 3.59 = $313,988 Year 19 @ 3.57 = $325,205 Year 20 @ 3.55 = $336,762 Year 21 @ 3.54 = $348,668 Year 22 @ 3.52 = $360,934 Year 23 @ 3.50 = $373,570 Year 24 @ 3.48 = $386,589 Year 25 @ 3.47 = $400,000 Year 26 @ 0.0 = $400,000 Year 27 @ 0.0 = $400,000 Year 28 @ 0.0 = $400,000 Year 29 @ 0.0 = $400,000 Year 30 @ 0.0 = $400,000 Year 31 @ 0.0 = $400,000 Year 32 @ 0.0 = $400,000 Year 33 @ 0.0 = $400,000 Year 34 @ 0.0 = $400,000 Year 35 @ 0.0 = $400,000 Year 36 @ 0.0 = $400,000 Year 37 @ 0.0 = $400,000 Year 38 @ 0.0 = $400,000 Year 39 @ 0.0 = $400,000 Year 40 @ 0.0 = $400,000 traditional homeownership

|

Rounding may cause fluctuations in individual yearly totals. The program applied was a sample program designed to minimize the magnitude of gains for The Wealthy Homeowner™ strategy applied, real returns generally far exceed these conservative estimates. Risk reduction strategies could cause overall gains to be modified creating either positive or negative variations in a plan. These results were created for demonstration purposes only and direct engagement with a homeownership advisor is required to prevent misuse.